A New Kind of Advisory in Seconds.

Evenly PayPredict. The only tool that protects you and your clients in one place. Then helps you grow.

Questions? Contact our Team

Evenly PayPredict. The only tool that protects you and your clients in one place. Then helps you grow.

Questions? Contact our Team

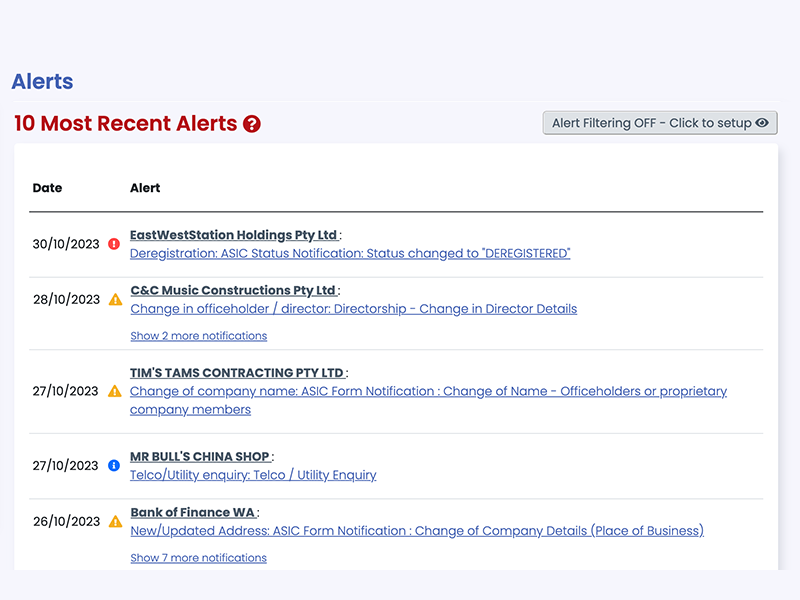

Get unique customer reliability insights to share with your clients in seconds, then PayPredict monitors 24/7 for anything you need to worry about and alerts you if anything comes up. See the things PayPredict monitors for you HERE

LEARN MORE about Customer Reliability and why it matters.

Can your clients rely on their customers to pay them on time and not affect their cashflow?

Evenly Risk Scores are incredibly accurate customer payment behaviour predictions built from hundreds of internal and external data sources.

Discover if customers will pay existing or upcoming invoices as promised with real time alerts for any major issues.

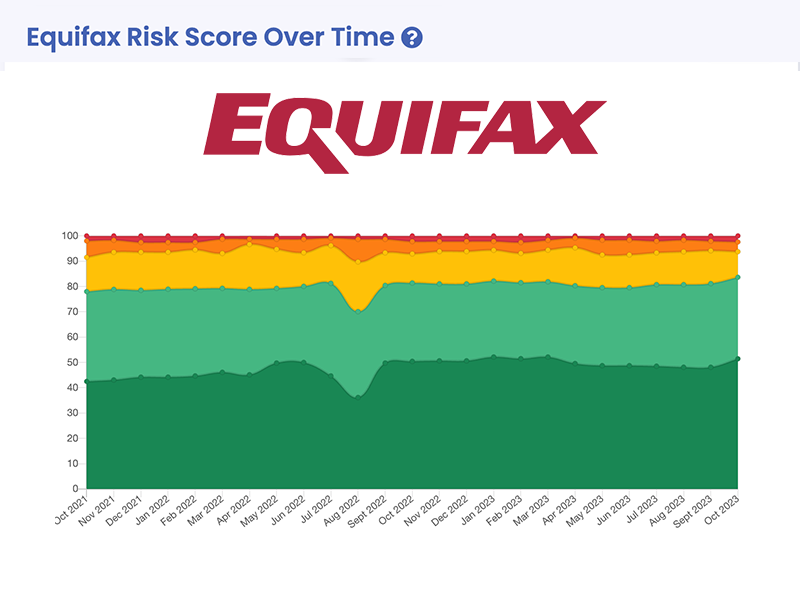

Equifax, Australia's largest credit bureau, measures the likelihood that your client's customers will run into business problems over the next 12 months.

Get FREE Equifax scores, alerts and more directly inside PayPredict.

Want to buy full reports from Equifax? You can do that too, straight out of any customer profile.

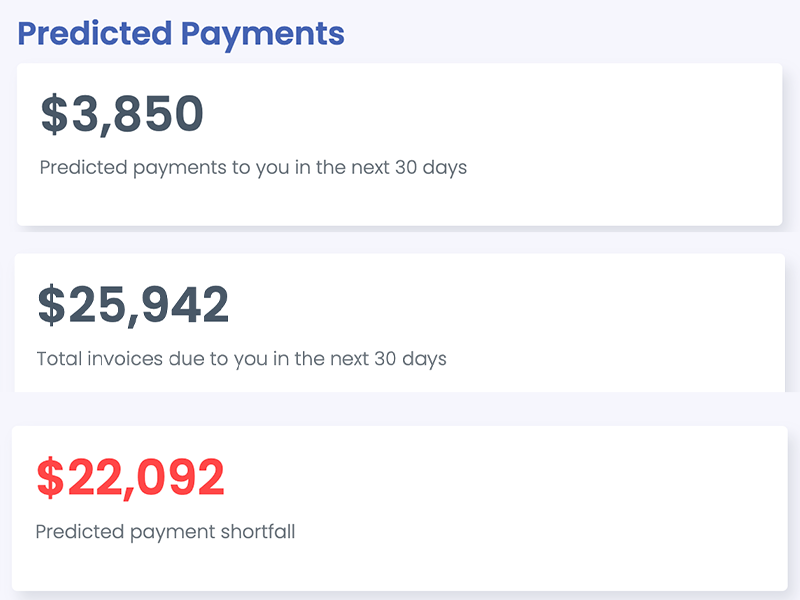

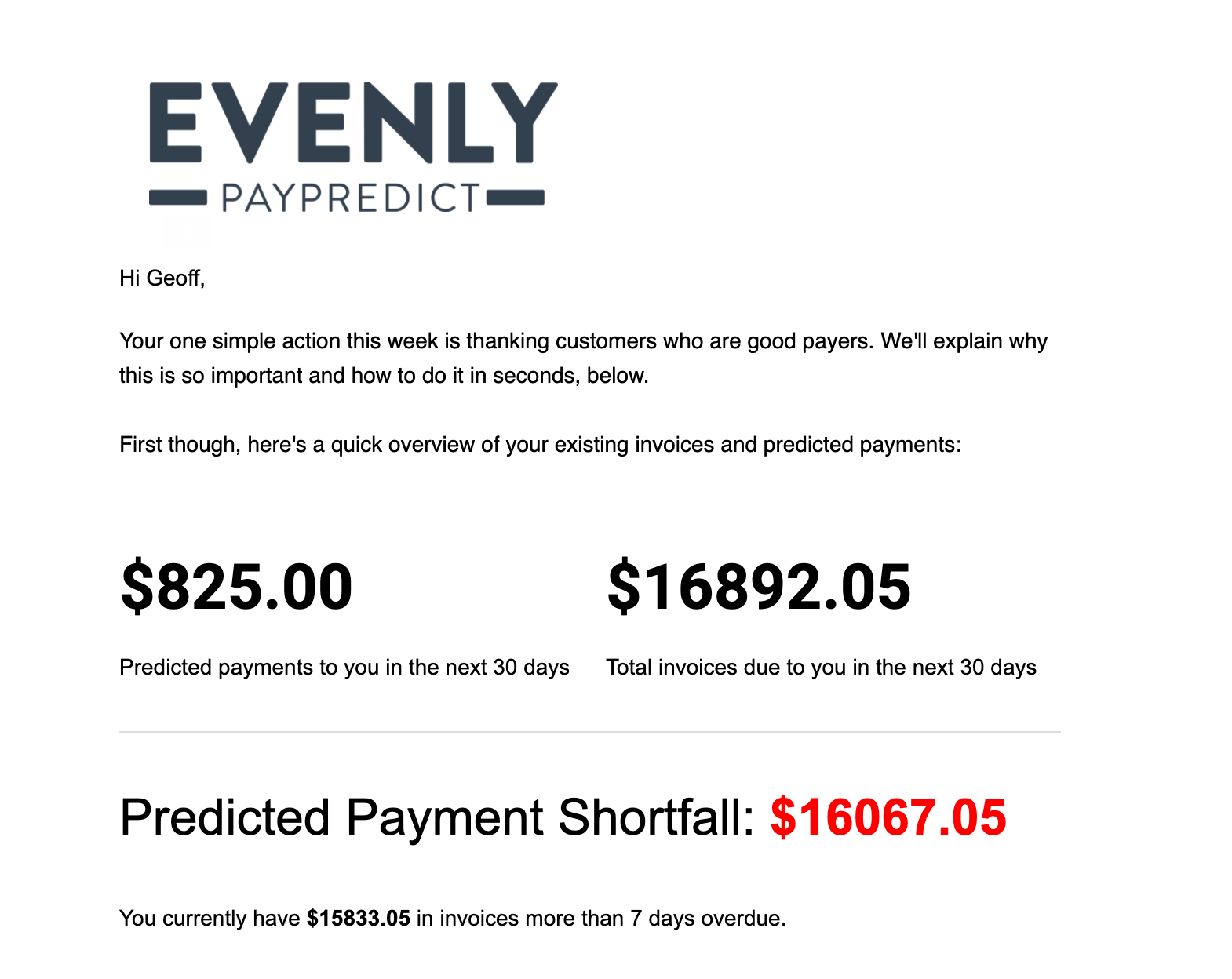

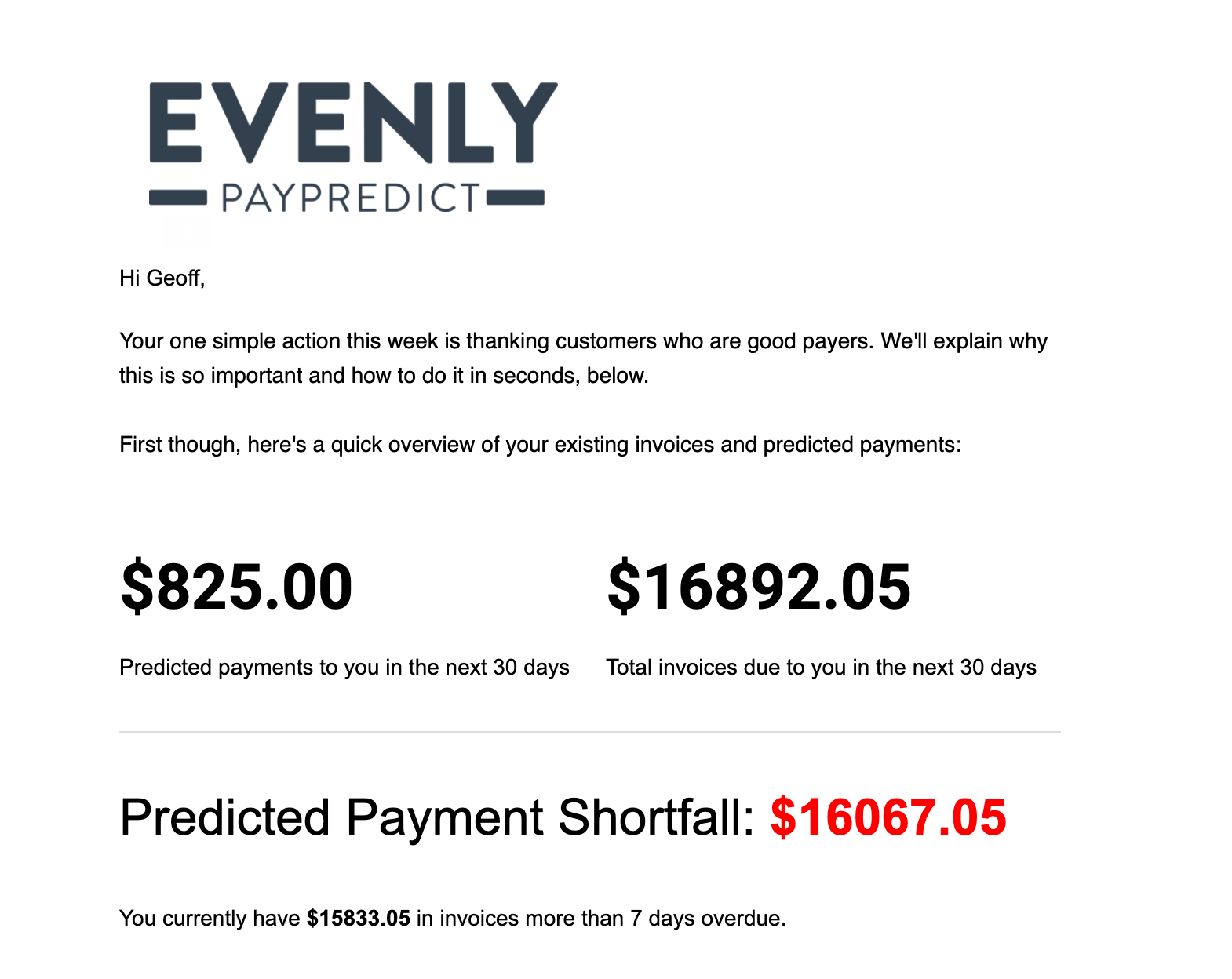

PayPredict gives you amazingly accurate 30-day predicted income forecast based on an AI-driven prediction of the exact payment date of each current invoice.

Combined, these predictions give you a crystal ball into actual future invoice payments and income.

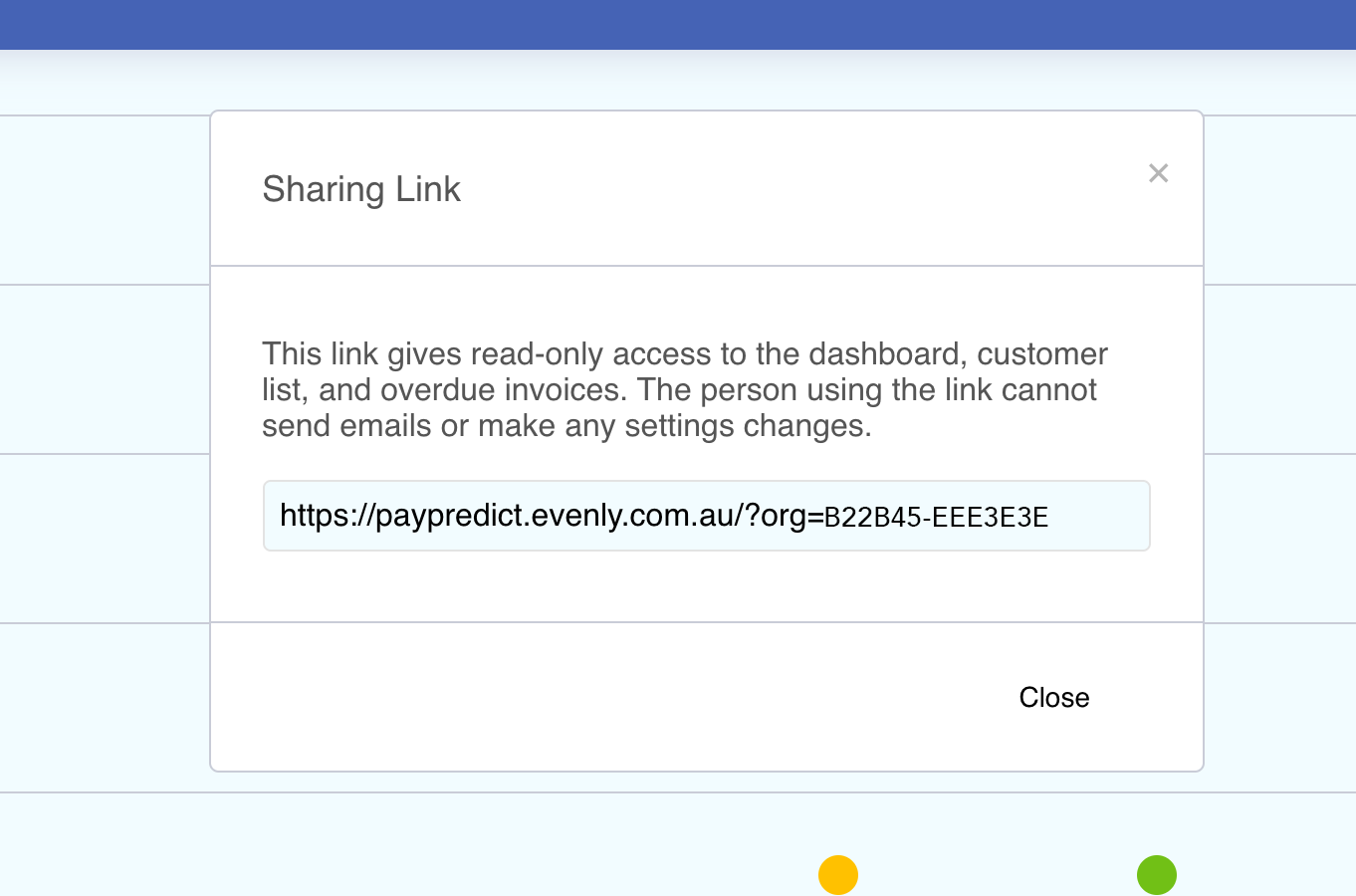

Share read-only dashboard links with clients to help drive your advisor conversations or give them access to take actions too.

PayPredict gives you the flexibility to work with your client in the way that best fits your advisor/client relationship.

Customer Reliability has a huge impact on your clients, both short and long-term, yet it's never really been measured well.

PayPredict measures and monitors both of these in completely new ways, giving you actionable insights and reports that drive client conversations, improve client resilience and help make sure your clients are around to be your clients, for years to come.

Whether moving from compliance to advisory, or building on existing advisory services - PayPredict is the tool you need to save time and start adding more value to your clients.

PayPredict is $24.99/month, per Xero account, with unlimited customer tracking and users. That's it.

No price tiers to track extra customers. No price upgrades for extra features. Just one price for everything you need.

More than 1 client? Contact Us to talk about Advisor Partner Pricing.

Save time with simple insights, delivered to you when you need them, then follow up with simple, proven, suggested actions. All built to save you time to focus on your business.

Some things can't wait. When there's an urgent alert we think you should know about we send it to you and any other authorised users straight away.

You have the alert. Now what? Alerts also have recommendations included so you know possible next steps.

Weekly emails give you an overview of income prediction and overdue invoice amounts. Each weekly email also has one simple action that will take 2 minutes to complete at most.

Data shows if your weekly tasks are completed by someone associated with your business, customer-related issues will be reduced. It's that simple.

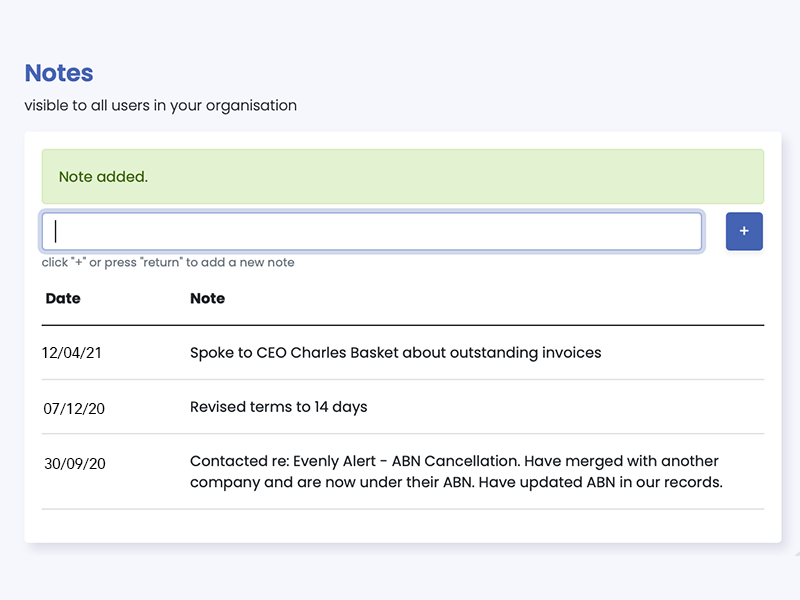

Make notes about a customer - e.g. actions you've taken or conversations you've had - and they're available to all other authorised users on your account to make sure nothing slips through the cracks.

Start Now - It's Free!

Not quite ready yet? Talk to our Team

Fill in the form below and we'll get back to you straight away