Customer Reliability and Why It Matters.

The foundations of business are pretty simple.

Suppliers need to provide products or services as promised and customers need to pay for them as agreed. Over time if you keep supplying the things customers need, as promised, then customers should continue to pay for them and your business grows.

That pretty much sums up the legal, economic and operational aspects of business in 2 sentences. In practice things are rarely that simple, though. There are many obvious reasons why things become more complex but one of the more important that not many businesses have enough information about is customer reliability - or how well a customer can live up to their end of the bargain.

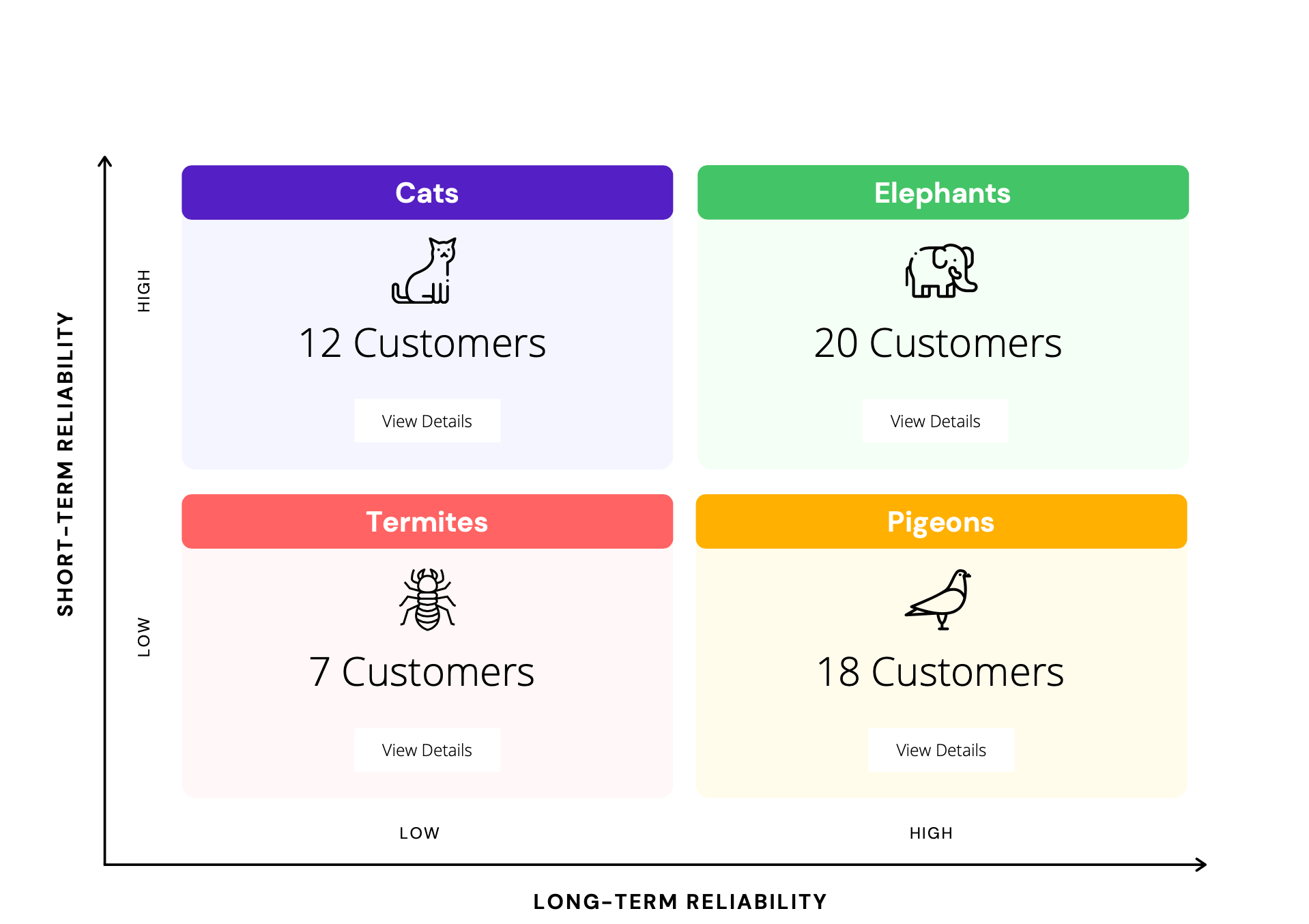

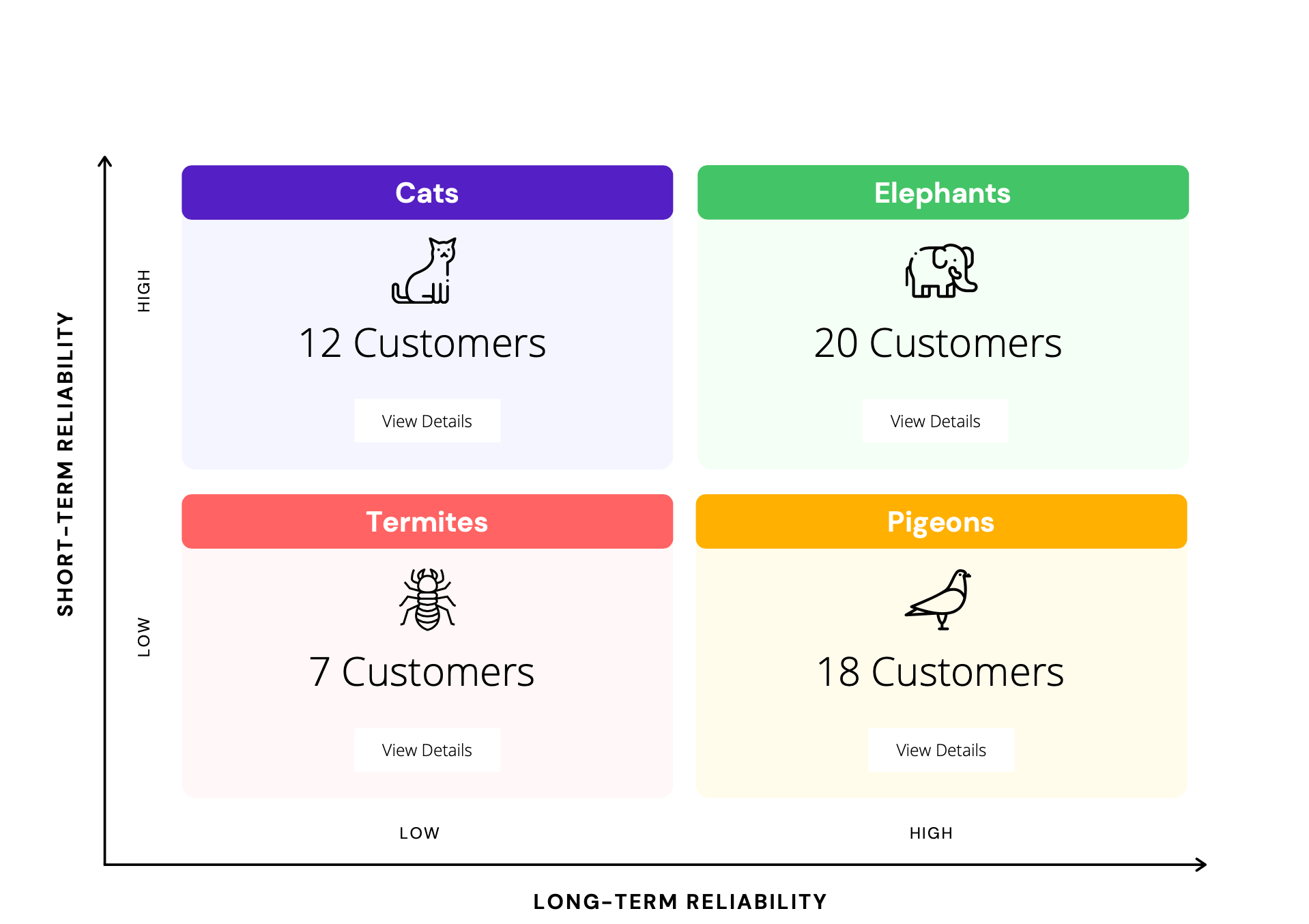

Evenly's Customer Reliability model uses AI-driven insights to answer the question of whether your existing customers - the ones who want you to continue supplying to them - will help, or hinder, your business growth.

Customer Reliability shouldn’t be confused with Customer Retention. Customer Retention is about trying to reduce the chances a customer will switch to a competitor or substitute solution and is typically a function of your offering and how well it meets your customer’s needs.

Customer Reliability, on the other hand, is focused on customers who actually want you to continue supplying to them and asks “Are these the best customers for my business?”. It’s typically a function of external forces such as issues your customers themselves are running into.

Customer Reliability can be broken down into 2 categories. Short and Long-Term Reliability.

Together, this short and long-term view of your customers is critical for building a resilient business.

One of the reasons why Customer Reliability matters is because of the additional costs associated with problem customers.

All businesses have overheads and most bear marketing costs similar to their peers. But once a business actually services customers there are additional costs added to the business that need to be recovered.

Where customer retention is poor, you have income issues but you don’t have those additional costs. Where customer reliability is poor you have income issues but you also have those additional costs. In many senses, unreliable customers are worse than no customers at all!

Until recently, trying to get in front of short-term Customer Reliability issues was incredibly difficult - especially for the SMBs that are most affected by it. It simply wasn’t possible for most small businesses to do what PayPredict does, using AI-driven algorithms based on hundreds of internal and external data points, many of them real-time, to predict likely reliability issues in advance.

For long-term reliability, businesses could use Commercial Credit Bureaus but these typically produced insights targeted at mid-to-large businesses with professional accounting, risk or finance functions. Not only were they complex they were also generally expensive.

Then in 2020, Evenly, which produces Australia’s best SMB credit risk insights, partnered with Equifax, Australia’s largest credit bureau, to create PayPredict and the game changed.

In one product, and in only seconds after connecting your accounting system, business owners get the world’s best reliability insights as well as alerts of changes and recommended actions to take to make sure your customers are as reliable as possible.

Customer Reliability isn’t the only thing that a business needs to worry about but it is important and has been neglected for too long only because of how hard it used to be to get accurate insights and predictions.

PayPredict changes that.

Learn more about what PayPredict's Customer Reliability categories mean HERE or jump in and Get Started With PayPredict Now.