Evenly - PayPredict Help Centre

On this page you'll find everything you need to get started and continue enjoying using PayPredict.

If anything is missing or you have any additional questions, please feel free to contact us

On this page you'll find everything you need to get started and continue enjoying using PayPredict.

If anything is missing or you have any additional questions, please feel free to contact us

What information is on the dashboard?

Getting started with Evenly PayPredict is super simple.

And that's it! You're now setup.

Registered Accountants and Registered Bookkeepers

If you are a registered accountant or bookkeeper please visit our dedicated advisor page for more information about how PayPredict helps advisors add value to their clients and to get started.

Once you’re registered and have accessed your dashboard, you'll see a series of numbers and graphs across 3 rows.

PAYMENT PREDICTION

The top row gives you an overview of invoices due in the next 30 days, how much of that we predict you’ll actually received and the difference (or shortfall) between the two. Use this to help with your cashflow forecasting.

RISK DATA

Below that you’ll see charts with Evenly and Equifax (Australia's largest credit bureau) risk data.

NB** If you don't have ABN data in your underlying customer record you will miss out on hundreds of data points for your Evenly risk scoring and we won't be able to provide Equifax insights. See below to find out how you can make sure you have ABNs added.

The donut (circular) graph is a breakdown of your customers by risk type, right now. The chart underneath it shows you how that breakdown has changed over time so you can see if your customers are getting more or less risky.

NB** It's important that you reconcile your accounts at regular intervals. The longer the time between reconciliation, the less accurate the Evenly assessment of payment risk will be.

To view any specific customer run detail click on "View all customers", find the relevant customer and click into their individual customer profile page.

If you like to be more hands on, you can jump into your dashboard any time and keep on top of things from there.

OVERDUE INVOICES

Next to the charts you'll see a summary of current overdue invoices. You'll also see an option to turn automated invoice reminders on and off here (we highly recommend you use this feature). Learn more about Automated reminders here.

ALERTS AND RECOMMENDATIONS

Finally, at the bottom of the dashboard you'll see a list of alerts about your customers and suggested actions in relation to those alerts. You can read more about the things we track here. Please note that Alerts and recommendations are only included in our Paid accounts. For more detail on pricing Click Here

Details on current PayPredict pricing can be found on the Pricing Page

If you're an accountant or bookkeeper with more than 5 clients please visit our advisor page or contact us to find out how to get your own practice overview page along with discounted pricing.

Does PayPredict collect any financial information about my business?

No. PayPredict only collects information about how your customers have paid you and does not view or collect financial information about your business including your own payment history or your financial position more generally.

Will PayPredict have access to my Xero password?

No. The Xero login box on our site is provided by Xero. PayPredict has no visibility of, or access to, your username and password information as it is encrypted and sent directly to Xero. PayPredict simply receives authority to access your Xero account from Xero if they have verified your login details are correct.

How do you determine Evenly payment risk / which colour a traffic light will be?

In order to maintain the integrity of the PayPredict system, and to prevent it from being gamed, the exact variables that contribute to the algorithms which calculate payment risk probabilities, and their individual weighting, are not publicly available.

What we can say is that if you can make sure you have ABN information in your client contact profile in your accounting system, it will allow us to source hundreds of additional external data sources to make insights specific to your customers even better.

That having been said, if you think there’s an issue with how we’re reporting on a particular customer, please contact us and we’ll be in touch.

What is the Equifax Risk Score?

Equifax is Australia's largest credit bureau and one of the big 3 globally. For over 120 years, Equifax has provided risk information to consumers and businesses.

Through Evenly's partnership with Equifax we're able to display Equifax risk information, something that would normally cost ~$25 per customer, free of charge inside PayPredict. You can learn more about Equifax's business offerings here.

In addition, if there's an alert you'd like more detail on (e.g. a change in customer company structure etc.) you can purchase Equifax reports via a direct link from within PayPredict.

What events will PayPredict monitor for and notify me of?

In the process of monitoring and then predicting customer payment behaviour, PayPredict monitors for key events might negatively affect a business and, as a result, affect how that customer might thenm go on to pay you, if they remain in business at all.

Explore the events PayPredict monitors for you HERE

I think a customer score is incorrect. What do I do?

Sometimes Evenly or Equifax risk scores may be represented incorrectly in PayPredict.

For Evenly scores this is normally due to either your accounts not being updated regularly (i.e. you haven't reconciled your accounts recently) or an incorrect name or ABN is being used for your customer.

For Equifax scores this is normally due to an incorrect ABN being manually entered, or automatically matched by the Equifax system, against a customer name.

If you've checked these and still believe that a customer score is incorrect, please follow these steps:

FOR EVENLY SCORES

A member of the Evenly support team will respond ASAP to help resolve your issue.

FOR EQUIFAX SCORES

I think my score being shown to PayPredict Users is incorrect. What do I do?

Sometimes Evenly or Equifax risk scores may be represented incorrectly in PayPredict, which means your suppliers may receive the wrong risk data about you, as a customer.

It's important to note that both Evenly and Equifax use multiple external data sources to generate their scores and, as such, any incorrect scoring tends to be as a result of those underlying data sources being incorrect.

Both Evenly and Equifax are committed to resolving any errors in underlying data sources, where possible.

If you believe your displayed score is incorrect, please follow these steps:

FOR EVENLY SCORES

A member of the Evenly support team will respond ASAP to help resolve your issue.

FOR EQUIFAX SCORES

How do I cancel my account?

Cancelling your PayPredict account is as easy as logging into PayPredict, going to your account page then selecting Disconnect Xero.

When you disconnect your Xero account you'll also delete your PayPredict Account.

If the Xero account is on a paid plan and payment details are tied to your personal PayPredict account, disconnecting from Xero will automatically cancel any subscription you have.

Are there any privacy issues with sharing customer payment information?

No. PayPredict has written confirmation from the Australian Government's Office of the Australian Information Commissioner (previously known as the Privacy Commission) confirming that there are is no issue with PayPredict's approach to risk profiling.

Why do ABNs Matter?

Having the correct ABN associated with each of your customers - whether in your underlying accounting system or by using one of the tools we provide you with - is critical for getting the most relevant and up-to-date insights possible.

That's because an ABN let's us know exactly who your customer business is and allows us to add in as much data as possible to our risk insights.

If there is no ABN, Evenly can give you payment risk insights based on the data in your system, but you'll missing out on hundreds of other external data points which means the insights will be less reliable.

On the other hand, if there is no ABN, we're unable to give you any Equifax insights at all.

There are 3 simple ways to get those critical ABNs into your customer details:

How do Weekly Emails Work?

Weekly emails save you time by giving you a simple overview of your business. Included in each is:

Our data shows that performing the recommended action in the email, which varies from email to email, has a material impact on payment behaviour of your customers so is worth doing - especially as it normally takes no longer than a minute or two.

What is a Customer Profile Page?

When you click into a customer profile you'll see a number of important pieces of information.

This includes:

Together these data give you either a high level overview of your customer at a glance or, if you want to dig in deeper, tools to understand and modify your relationship with each individual customer you have.

How do Subscriptions work?

Once you get to the end of your Free 14 Day Trial of PayPredict, you can decide to keep using PayPredict and subscribe or you can cancel your service.

Pricing and features associated with subscription is available on the Pricing Page and terms of the subscription payments are on our Terms and Conditions Page.

How does the Payment Prediction tool work?

The difference between when an invoice is due and when it’s likely to be paid, can be huge

The Payment Prediction at the top of your dashboard predicts the exact date any outstanding invoices will be paid then sums all of the expected payments you’re likely to receive in the next 30 days.

We then give that to you as one simple number in your dashboard.

The Payment Prediction tool isn’t simply built on averages or your direct interactions with each customer. It’s a highly accurate prediction built by our data science team based on a variety of different data inputs.

What are automated emails?

PayPredict makes your life easy by providing a number of automated emails you can ask us to send on your behalf. The list of emails and what they look like can be found HERE.

How do automated invoice reminders work?

No matter how good we get at helping you reduce late payments, some customer will pay late. That’s where our automated reminders come in.

We send automated reminders for invoices at 7, 14, 30 days overdue, then every subsequent week after that.

Turning automated reminders off is simple. Go into your account settings in your PayPredict dashboard and you can easily turn them on and off.

Have any more questions? Please contact us.

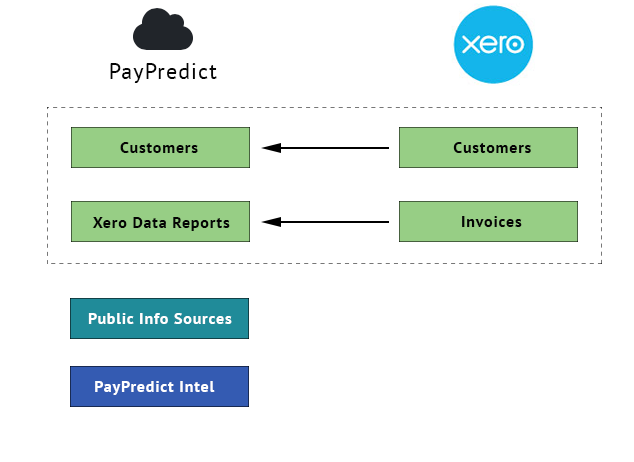

Evenly PayPredict integrates with your Xero accounts to access a list of your business customers (as determined by ABN) and to access invoice history to produce the simple-to-understand reports of how those business customers have paid you in the past.

We then analyse that information and marry it with 2 additional data sources so you can easily answer one question "Will I be paid on time or is there something I should be worried about?"

Below is an overview of that data flow from Xero