Following our previous article, it would be good to elaborate on Evenly and what sets it apart from other financial services. This article explains how Evenly is a powerful tool for your company and how it can help propel your business growth.

The underlying data Evenly uses is the invoices you’ve issued. It doesn’t consider whether your business is able to pay back its debts, but whether others can pay back their debts owed to you. It is concerned with credit risk assessment to help you manage your cash flows better.

(Source: All Top Startups)

(Source: All Top Startups)

Evenly takes your invoices and connects them back to your customers. It then uses hundreds of data sources to determine the risk of a company not paying its current or next invoice on time.

Internally, Evenly helps you manage your cash flows better because you can efficiently improve how your customers pay you. This is important because while invoicing for work is great, you can use income from work done to grow your business when those invoices have been turned into cash. Yes, cash is still king in 2020 and the more you have it, the more wiggle room your company has for it to grow.

(Source: Vector Stock)

(Source: Vector Stock)

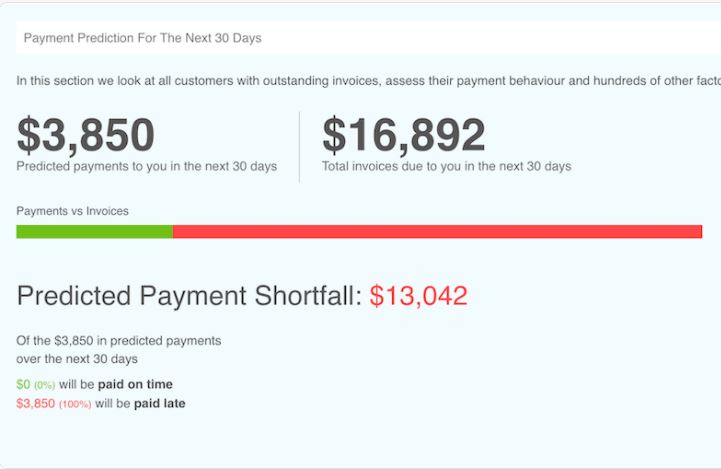

Evenly also provides you with a deeper dive on financial forecasting. Its has a payment prediction feature which gives you incredibly accurate predictions of actual monthly income vs what you expect from due dates.

This can help you have better results for your monthly recurring revenue because the algorithm lets you know how much of your monthly forecast has been realized.

Evenly also helps you better manage client relations by tracking data in real time. Once connected to your accounts, it keeps an eye on your customers 24/7, alerting you to anything you need to worry about. That’s not just bad alerts either. As customers become lower payment risks, Evenly alerts you too so you can better understand both sides of how customers pay and consequently incentivize or negotiate with your customers based on scientifically predicted insights rather than ‘gut feel’.

Nowadays, knowing when you’ll get paid may just be the right boost for your business to keep moving forward. Evenly helps by not only tracking your payment transactions 24/7, but also assessing the likelihood of customers paying your invoices as promised. It also predicts how much monthly revenue is projected for your company. All for just $15/month.

Click here to find out more about Evenly and how it can help your business grow.

← Back

If you issue invoices you need PayPredict.

The easy to use Xero app that let's you really know if your customers will pay on time.

Try PayPredict for free